We often think of allocating our dollars to causes that are important to our values through donations or purchasing goods. Let’s challenge ourselves to think beyond these, although they are critical, there is another way to make grand impact as well – sustainable, ESG investing, and impact/community investing. Think if you could provide change in causes like pollution & climate change, equity & inclusion, and even rewarding companies for the good they do in the community or the diverse voices they hire – how would you feel? Utilizing investment in your own portfolios as you seek to grow responsible wealth is exactly the concept that sustainable investing brings to the forefront.

When these type of investment strategies came into play in the 70’s it was more challenging to find companies that fit the qualifications and standards to be defined as ESG or sustainable investing. As companies have been more aligned with the need for change to positively impact environments, social communities, and even their own structure we have seen a increase overall as more and more companies that are signature names join the ESG qualifications. What does this mean for you as the investor? You no longer have to sacrifice return potential to also have your investments and wealth align with your values.

Let’s break down what all of this means more for you so you understand the true impact you can make now more than ever with your money. Sustainable investing by definition is an investment approach that considers environmental, social, and governance factors in the portfolio selection and management.

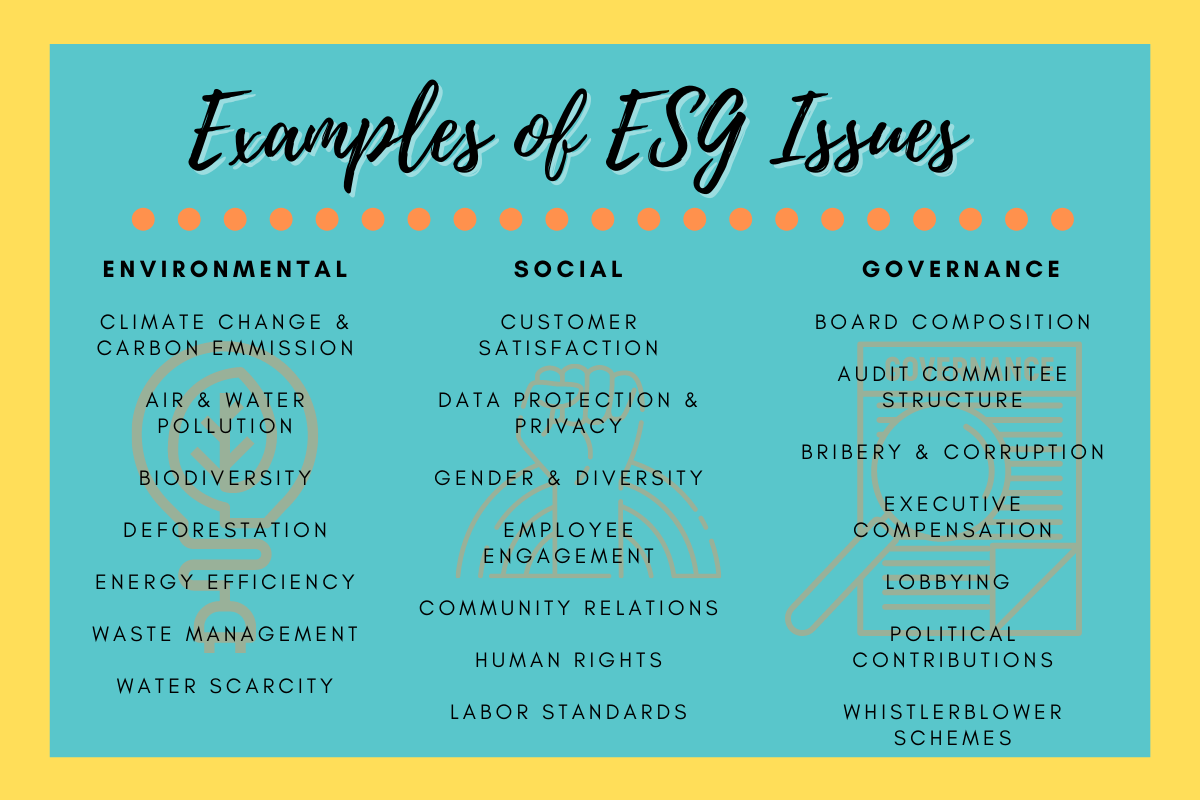

Here are examples of ESG Issues – Are any of the below near and dear to your heart?

Future forward thinking is not just a trend with ESG, don’t think of this as a fad either. This year 2020, has provided fluctuation in the markets. We will potentially continue to see levels of volatility as the economy recovers. If you compare the MSCI KLD 400 Social Index over the past 5 years from 2015-2020, which is the index or make of ESG companies to benchmark overall performance, with the S&P 500 Index, which is commonly used in the same way but for traditional companies — the MSCI KLD 400 has slightly outperformed the S&P 500. So, if you knew you didn’t have to sacrifice potentially return and invest in companies that are doing good and in line with your values, how would that change your philosophy in investing?

According to McKinsley Group research, over the next decade, there will be a wave of wealth transfer representing $30 trillion that will transition to women. I don’t think I need to tell you that women think differently about a lot of things in comparison to their male counterparts. Women care more about the impact of their money to themselves, the people they love, and their communities in comparison to the rate of return and the analytical pieces. Absolutely both are important, however our industry, heavily male-dominated has for so long focused on performance over planning. Plan first and design a portfolio to address that plan. If you focus on returns rather than impact to a woman’s life you’ll likely lose her. Right now, women are a driving force behind ESG investing. According to Morgan Stanley survey 2017, 84% of women expressed interest in sustainable investing versus 67% of men surveyed. Why? Women care about equal pay, the gender gap, racial equity, and so many of the above issues that fit into ESG investing.

Looking even further into the economic recovery and ESG investing. Have you seen companies making more statements on equity and their commitments to diversity in leadership position plus their commitments back to communities? I mean if you haven’t, with all due respect you may be living under a rock. Personally, I get excited, and also hope we as the people hold them accountable to real change not just positions at the table but culture change. How does this impact ESG investing though? Sustainable (ESG) Investing has long been thought at investments that are for the environment, that is one part, there is a more focused effort on social change of the “S”. Think for a moment — what will happen to companies who make the lasting and impactful change to equitable workforces while also driving profitability — they become more attractive and qualify as ESG forward companies. As the wealth transition happens, women and people of color will want to put more money in companies like this. When people invest more in companies they grow, their value and their stock (of course, nothing in our world is EVER guaranteed). Now, on the flip side, what would happen to a company that does not take this focus? How long will they be able to sustain without making change.

As you continue to evaluate your financial plan, goals, and the vehicles that are working to help you achieve them, I ask you to sit back and think if any of the above information sparks something in you. For me, I always knew this topic was something I wanted to learn more about. I grew up in the inner city of Minneapolis coming from a family that was creative, socially thoughtful, and considerate about the planet. I pushed from several positions I’ve been in for more firms to look at their impact. After growing tired from canned answers, I launched Forethought Planning in January 2020. Never would I think that in that same year two of my passions, planning/serving clients and sustainability/equity would literally become one of the hottest topics in my industry. Let’s not let it be a flavor of the season, instead lasting change that shifts of focus forward to impact change. For the month of November, myself and my company Forethought Planning will be focusing on educational content around sustainable investing. Stay connected with us by subscribing to our email content by visiting our website link below, follow us on LinkedIn, Facebook, and YouTube, and also subscribe to our podcast Thrive For[e]ward.

Resources:

Source: CFA Institute. Environmental, Social, and Governance Issues in Investing. A Guide for Investment Professionals https://www.mckinsey.com/~/media/McKinsey/Industries/Financial%20Services/ Our%20Insights/ Women%20as%20the%20next%20wave%20of%20growth%20in%20US%20wealth%20manageme nt/Women-as-the-next-wave-of-growth-in-US-wealth-management.pdf?shouldIndex=false https://www.mckinsey.com/industries/financial-services/our-insights/women-as-the-next-wave-ofgrowth-in-us-wealth-management#signin/download/ %2F~%2Fmedia%2FMcKinsey%2FIndustries%2FFinancial%20Services%2FOur%20Insights%2FWom en%20as%20the%20next%20wave%20of%20growth%20in%20US%20wealth%20management%2 FWomen-as-the-next-wave-of-growth-in-US-wealth-management.pdf%3FshouldIndex%3Dfalse/1 https://www.3blassociation.com/insights/sustainable-investing-is-here-to-stay-and-women-are-takingthe-lead https://impaxam.com/news-and-views/blog/the-investment-case-for-sustainability-the-rise-of-resilience/

DISCLOSURES: This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change. References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy. This Research material was prepared by LPL Financial. Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Advisory services provided through Advisor’s Pride. Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. All investing involves risk including loss of principal. No strategy assures success or protects against loss. Environmental Social Governance (ESG) investing has certain risks based on the fact that the criteria excludes securities of certain issuers for non-financial reasons and, therefore, investors may forgo some market opportunities and the universe of investments available will be smaller. The MSCI KLD 400 Social Index is a capitalization weighted index 400 US securities that provides exposure to companies with outstanding Environmental, Social, and Governance (ESG) ratings and excludes companies whose products have negative social or environmental impacts. The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.