Money touches every aspect of our lives. Change is a constant with life transitions feeling like they are piling one on top of another. As a woman you tend to be a natural nurturer, taking care of everyone else around you.

Money flows and goes. Wealth stays. Stop treating your wealth like money and start nurturing it.

However, it’s not our fault always that we don’t take more ownership with our wealth as women. Society, our family, environment, and cultures have taught women over time that money isn’t for us to worry about. This is a flat out lie.

Women will live longer than men. We will care for the loved ones around us and if we don’t start to take initiative to learn more about our wealth than we are leaving the control up to someone else.

Honestly, it doesn’t matter if your family has money or doesn’t – YOU need to learn how to have healthy behaviors with your money.

What is your wealth story?

Your vision for your wealth can be impacted from your past. The reason you haven’t taken a step forward in your financial life – whether it is organizing your financial house, setting up systems, asking for a raise, increasing your prices, you {insert your financial block} – it’s stemming from a narrative internally you are telling yourself either consciously or subconsciously. You need to heal from this before you can employ any strategy. We refer to this as building a solid foundation and a healthy wealth vision statement.

Questions to ask a yourself:

· What conversations happened (or didn’t) in my household growing up?

· What images of wealth was I surrounded by in my life?

· Who did I see that controlled the financial decisions?

Now follow with, which one of these pieces served you and which ones did not.

🛑 Stop sitting on the sidelines

Imagine this for a moment, what if we as women adapted our conversations to include true pieces of our financial picture and goals that were important to us. Often times if money is involved in a conversation it has to do with what we are spending rather than – earning, saving, and investing. I met with a women’s investment group last month. They greeted me at the door countless times with – “We are so glad you are here, we know nothing.” The difference is, they gathered a group together, enlisted a professional to come speak to them, and then they were vulnerable to ask questions. Guess what the outcome was? They learned. You won’t learn if you don’t seek curiosity and ask questions.

Imagine this for a moment, what if we as women adapted our conversations to include true pieces of our financial picture and goals that were important to us. Often times if money is involved in a conversation it has to do with what we are spending rather than – earning, saving, and investing. I met with a women’s investment group last month. They greeted me at the door countless times with – “We are so glad you are here, we know nothing.” The difference is, they gathered a group together, enlisted a professional to come speak to them, and then they were vulnerable to ask questions. Guess what the outcome was? They learned. You won’t learn if you don’t seek curiosity and ask questions.

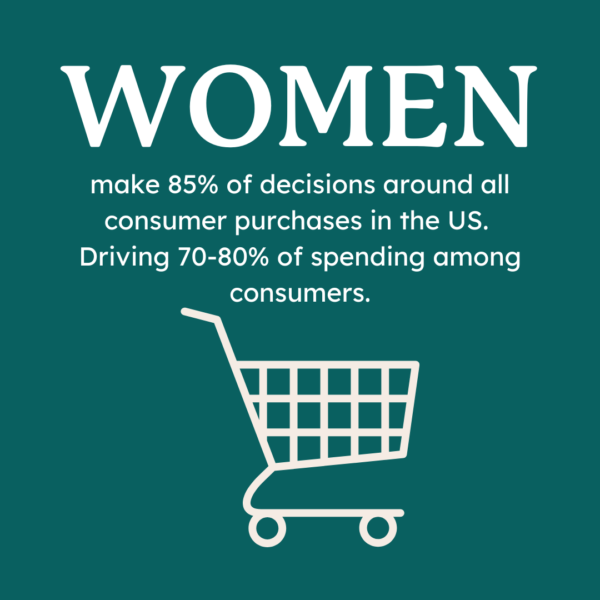

When you walk into one of our favorite stores, Target, who is their client avatar? A busy woman. How many other brands tailor their advertising to women? It’s because we have taken over spending in the US households. If we can have an impact there, what would happen to wall street and investments if they knew women wanted to invest and change the world?

Rather than gathering for jewelry, clothing, and tupperware parties we put a twist on it and gathered for wealth empowerment nights. I was recently with my women’s business group and we called it billions and brunch or dinner and dollars! Make a fun spin on it – pick a topic and heck hit our email and let us know if we can help break down some content for you.

Check out more of our blogs, videos, and podcast about how to become more involved in your wealth story. Take it one step further and schedule your complementary Wealth Assessment today with our team of professionals that will help guide and empower you to through your wealth transformation. Schedule today!

Sources: https://www.lexingtonlaw.com/blog/finance/women-spending-habits.html

Securities offered through LPL Financial, a member of FINRA/SIPC. Advisory services offered through Forethought Planning a SEC registered investment advisor. LPL Financial and Forethought Planning do not offer legal services.